A Glossary of Impact Investing & Sustainable Finance Terms, Jargon and TLA's.

Need to make sense of the technical terms being thrown around? Scan or search this alphabetical glossary for a quick reference and get clarity in the noise.

0-9.

1.5 Degrees: The 1.5 degrees Celsius limit refers to the global target established within the United Nations' 2015 Paris Agreement, aiming to restrict the increase in the Earth's average temperature above pre-industrial levels to no more than 1.5 degrees Celsius. This ambitious target is based on scientific projections provided by the Intergovernmental Panel on Climate Change (IPCC). The significance of the 1.5 degrees Celsius limit lies in its role as a critical threshold in averting some of the most severe consequences of climate change. Exceeding this limit would lead to the widespread occurrence of devastating climate impacts, posing substantial risks to billions of people and causing irreversible harm to the environment.

A.

Accounting for Sustainability (A4S): A framework developed by The Prince of Wales's Accounting for Sustainability Project to integrate sustainability into financial reporting and decision-making. Learn More

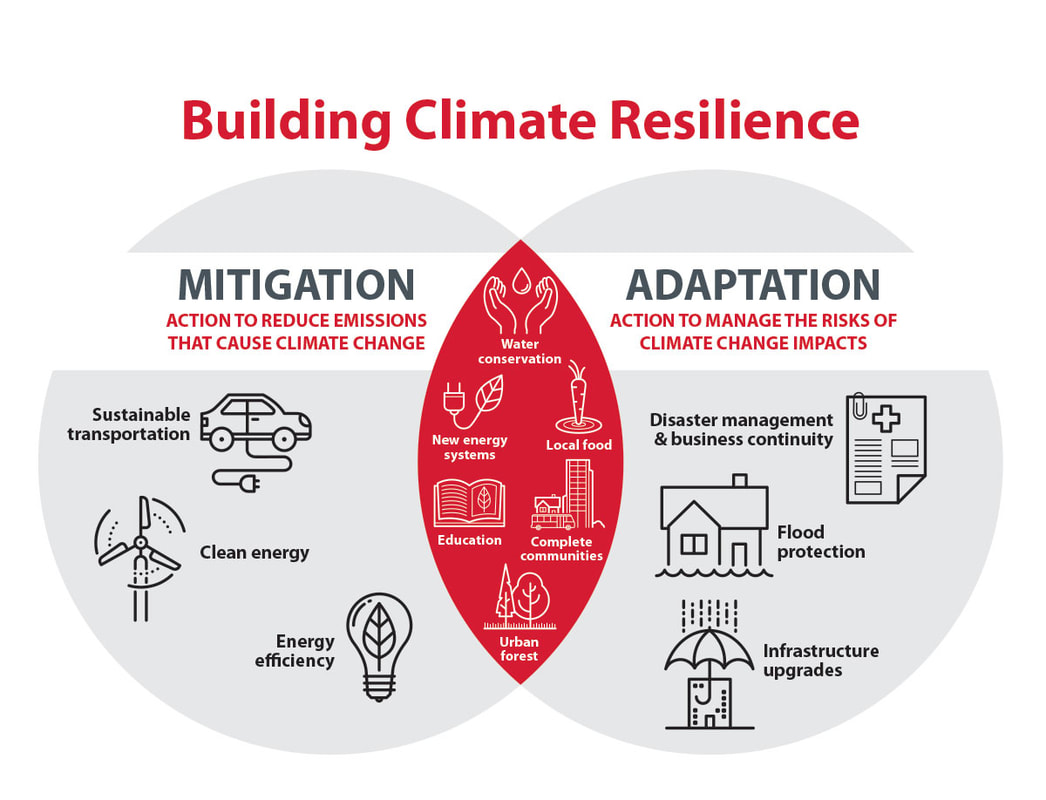

Adaptation Finance: Financial resources provided to support efforts to adapt to the impacts of climate change. It includes funding for projects and initiatives aimed at enhancing resilience to climate-related challenges.

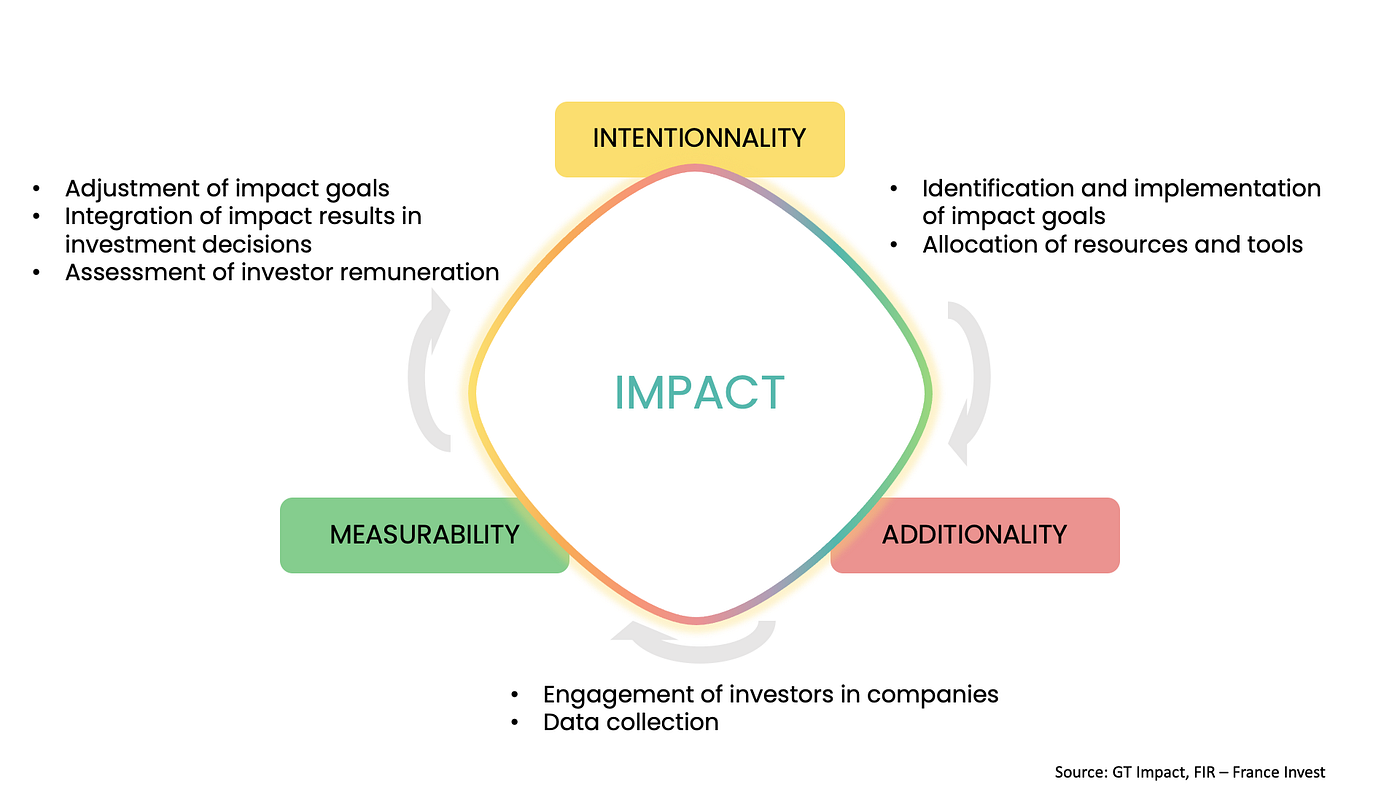

Additionality: Signifies that an intervention results in, or has resulted in, outcomes that would not have occurred in its absence. In the context of impact, it entails achieving positive results that surpass what would have transpired without the investment. Additionality can arise from: i)The growth of new or underserved capital markets. ii) Providing flexible capital and accepting returns that are disproportionate relative to risk. & iii) Active engagement offering a wide range of non-financial services.

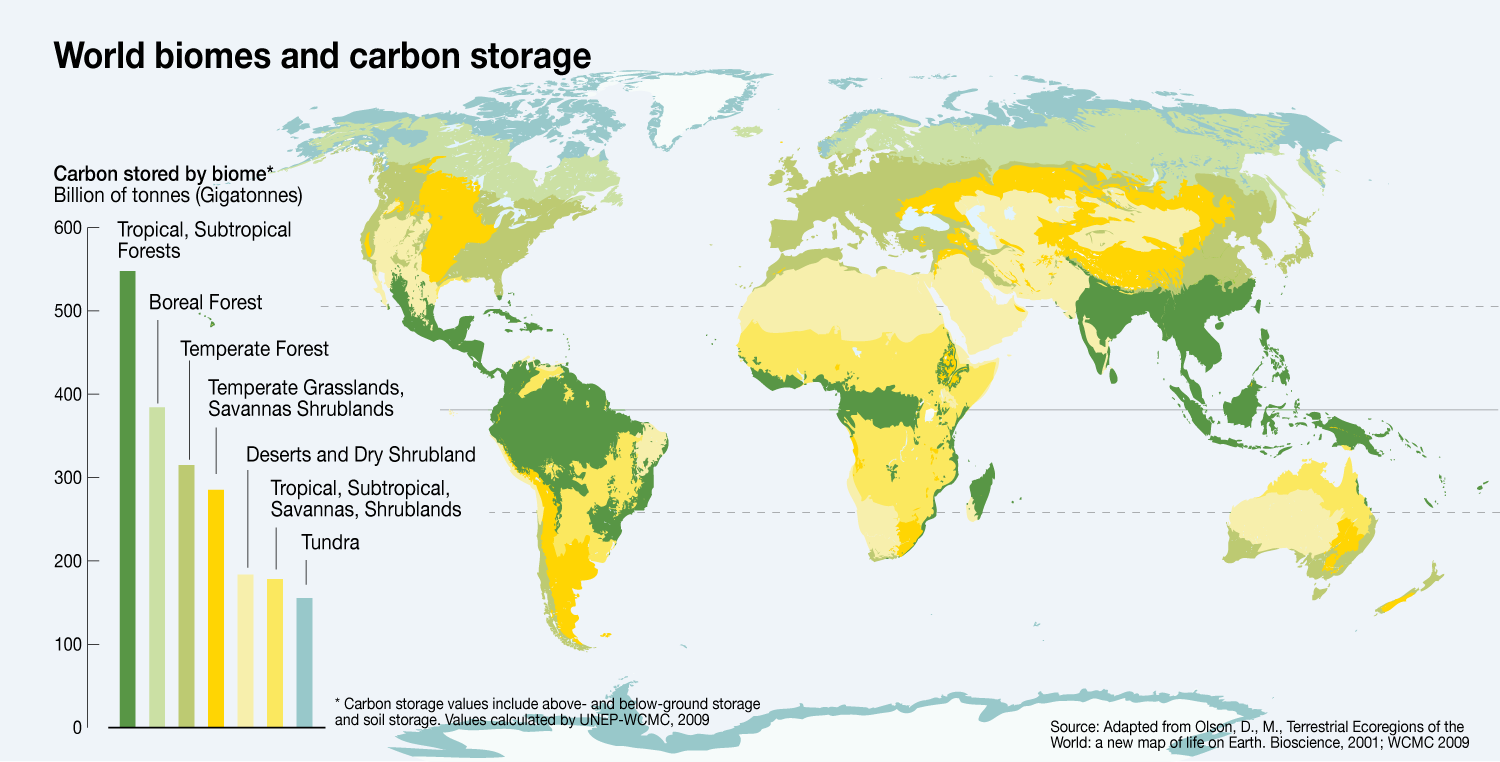

Afforestation: The deliberate and planned process of establishing forests or tree plantations in areas that were previously devoid of significant tree cover. It is a proactive approach to combat deforestation and address environmental challenges such as climate change, habitat loss, and soil erosion.

Agroforestry: A land use management system that combines agriculture and forestry practices by planting trees or shrubs alongside crops or livestock to enhance sustainability and ecosystem services.

AICPA (American Institute of CPAs) ESG Reporting Framework: The AICPA ESG Reporting Framework provides guidance on reporting environmental, social, and governance (ESG) information. It helps organizations communicate their ESG performance effectively to stakeholders. Learn More

AIGCC (Asia Investor Group on Climate Change): An initiative to raise awareness and motivate action among Asia’s asset owners and financial institutions regarding climate change and low carbon investing. Learn more

AIMM (Anticipated Impact Measurement and Monitoring System): A system used by the International Finance Corporation (IFC) to predict, measure, and monitor the development impact of investments. Learn more.

Alternative Investments: Non-traditional investment assets, such as private equity, hedge funds, real estate, and commodities, used to diversify portfolios and potentially enhance returns.

Angel Investor: An individual who provides capital to startups and early-stage companies in exchange for equity ownership. Angel investors often offer not only financial support but also mentorship and industry expertise.

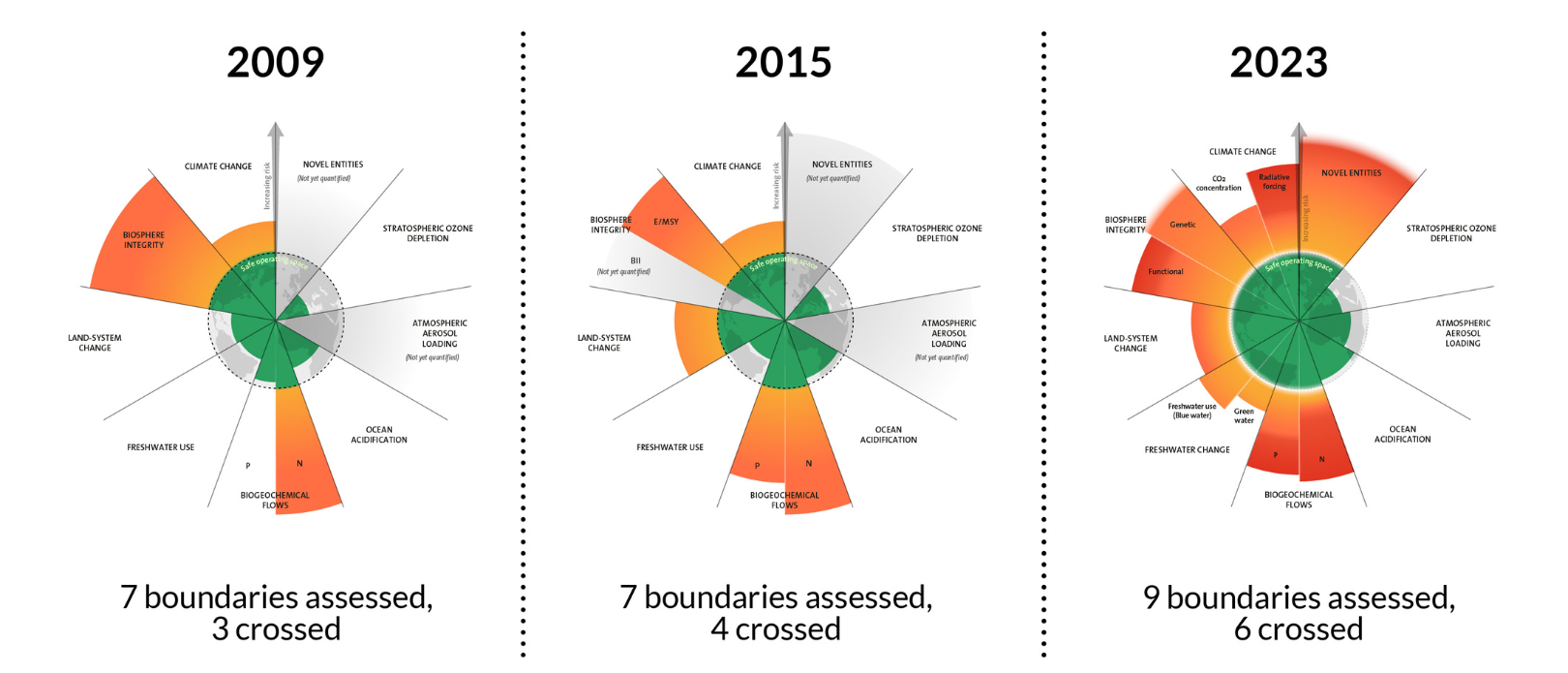

Anthropocene: The Anthropocene is a proposed geological epoch characterized by the significant and lasting impact of human activities on the Earth's geology and ecosystems. It represents a new phase in Earth's history, distinct from previous epochs, where human activities have become a dominant force shaping the planet's natural systems. The term "Anthropocene" is derived from the Greek words "anthropo," meaning human, and "cene," meaning new or recent.

Annex I Parties: Countries listed in Annex I of the UNFCCC, primarily industrialized nations committed to reducing their greenhouse gas emissions. Learn more

Annex II Parties: Comprising OECD members from Annex I (excluding EIT Parties), these parties are obligated to provide financial resources to assist developing countries in emission reduction activities under the Convention and adapt to climate change impacts. Learn more

AODP (Asset Owners Disclosure Project): A ranking of climate-related financial disclosures of the world's largest pension funds, insurers, sovereign wealth funds, and endowments.

Aquaculture: The farming of aquatic organisms such as fish, mollusks, and crustaceans in controlled environments, including ponds, tanks, and cages, to produce food products.

Article 9: Refers to a specific section of international climate agreements, such as the Paris Agreement under the United Nations Framework Convention on Climate Change (UNFCCC). It addresses the provision of financial resources, technology transfer, and capacity-building support to developing countries for climate action. Article 9 outlines the commitments of developed countries to assist developing countries in their efforts to mitigate greenhouse gas emissions and adapt to the impacts of climate change. It is an essential element of international climate cooperation, emphasizing financial and technical assistance to promote sustainable development.

Article 9 Fund: This fund is specifically dedicated to fulfilling the commitments outlined in Article 9 of the agreements. Article 9 addresses the provision of financial resources, technology transfer, and capacity-building support from developed countries to developing countries to assist them in mitigating greenhouse gas emissions and adapting to the impacts of climate change.

Asset Allocation: The strategic distribution of an investment portfolio across various asset classes (e.g., stocks, bonds, real estate) to achieve specific risk and return objectives.

Asset Management Company: Asset Management Companies are organizations specialized in assisting clients in investing their capital across various asset classes, including stocks, bonds, real estate, and other investment forms.

Attribution: Attribution considers the extent to which observed changes result from the activities of the organization versus actions taken concurrently by others, such as other social purpose organizations or the government.

AUM (Assets Under Management): Refers to the total market value of the assets that a financial institution or fund manager manages on behalf of investors.

AVPN (Asian Venture Philanthropy Network): AVPN is a nonprofit organization in Asia committed to catalyzing the potential of social investing for social impact. It connects, equips, and educates a diverse group of stakeholders in the social investment ecosystem. Learn More

B.

B Corporation: Companies meeting high standards of social and environmental performance, transparency, and accountability, certified by the non-profit B Lab. The certification requires a rigorous assessment process.

BCR (Benefit-Cost Ratio): A financial ratio that attempts to summarise the overall value for money of a project or proposal. A BCR greater than 1.0 indicates a potentially favorable investment.

Benefit Corporation: For-profit entities that legally embed societal benefits into their goals, balancing mission and profit. They provide directors with the legal framework to consider various stakeholders' impacts. Learn more

Best-in-Class Investing: Selecting investments from companies or assets that demonstrate superior ESG performance within their respective industries. It aims to identify leaders in sustainability.

B Impact Assessment: A tool used to assess the impact of a company on its workers, community, environment, and customers. It's commonly associated with B Corporations. Learn More

BIS (Bank for International Settlements): An international financial institution owned by central banks that fosters international monetary and financial cooperation and serves as a bank for central banks. Learn more.

Biodiversity Finance: Financial resources and investments dedicated to the protection, conservation, and sustainable use of biodiversity. It encompasses funding for initiatives that safeguard ecosystems, species, and genetic diversity. Biodiversity finance is critical for addressing the challenges of biodiversity loss and promoting ecological sustainability.

Biodiversity Impact Fund: An investment fund dedicated to supporting projects and initiatives that promote biodiversity conservation and habitat restoration.

Biodiversity Stripes: Biodiversity Stripes is a concept similar to Climate Stripes but applied to biodiversity data. It visualizes changes in biodiversity over time using a series of colored stripes, where each stripe represents a specific time period (e.g., a year or decade), and the color of the stripe indicates the state of biodiversity during that period. Biodiversity Stripes can show trends in species abundance, diversity, or other biodiversity metrics and are used to raise awareness about the loss of biodiversity and the need for conservation efforts. Learn More

Bioeconomy: An economic system and set of activities that use renewable biological resources from land and sea, such as plants, animals, and microorganisms, to produce goods, services, and energy in a sustainable and environmentally friendly manner. It involves the utilization of biological materials and processes to create products, chemicals, and energy while minimizing environmental impact and promoting resource efficiency.

Biofuel: Biofuels are renewable fuels produced from organic materials, such as plant matter (biomass) and algae. Common biofuels include ethanol and biodiesel, which can be used as alternatives to fossil fuels in vehicles and power generation.

Biomaterials: Derived from renewable resources, often found in nature, that are used in product manufacturing with a focus on sustainability and reduced environmental impact.

Biomimicry: An approach that draws inspiration from nature's designs, processes, and systems to create sustainable and innovative solutions for various human challenges.

Blended Finance: The combination of 'catalytic' capital from philanthropic or government sources and 'commercial' capital to fund sustainable development goals. It reduces risks for commercial investors, making high-impact investments viable.

Blue Finance: Financial mechanisms and investments aimed at supporting the sustainable management and conservation of marine and aquatic ecosystems. It addresses issues related to ocean health, fisheries, and coastal conservation.

BlueMark: A third-party certification and impact verification provider that assesses and verifies the impact of funds, asset managers, and companies in the impact investing space. Learn More

BOP (Bottom of the Pyramid): A socioeconomic concept that groups the largest but poorest socio-economic group, typically those with the lowest income.

(170).jpg)

BREEAM (Building Research Establishment Environmental Assessment Method): A sustainability assessment method for buildings and infrastructure. It measures their environmental, social, and economic performance. Learn More

C.

Capacity Building: Also known as organisational support, is an approach aimed at strengthening the performance of supported organizations by developing their skills, improving structures, and enhancing processes. It focuses on empowering organizations to achieve greater effectiveness and impact.

Capital Call: A formal request made by a venture capital fund or private equity fund to its investors (limited partners) for the payment of their committed capital contributions. When investors commit capital to a fund, they do not typically provide the full amount upfront. Instead, the fund makes capital calls as needed to finance investments in portfolio companies or other opportunities.

Cap-and-Trade: A regulatory system used in carbon markets where a government sets a cap on the total allowable greenhouse gas emissions and issues a limited number of emission allowances or permits. Companies can buy and sell these permits, creating a market for carbon emissions.

Capital Provider: An entity or individual that supplies capital through various financial instruments with the goal of achieving either financial returns, social impact returns, or both. These providers play a crucial role in funding initiatives and projects.

Carbon Credits: Represent reductions of greenhouse gas emissions, traded in carbon markets. They incentivize businesses and governments to achieve carbon-neutral or negative operations.

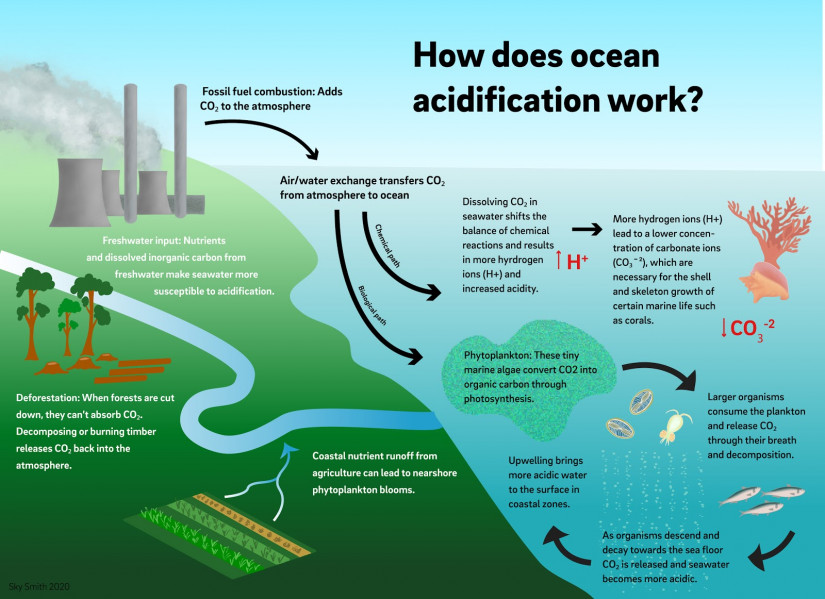

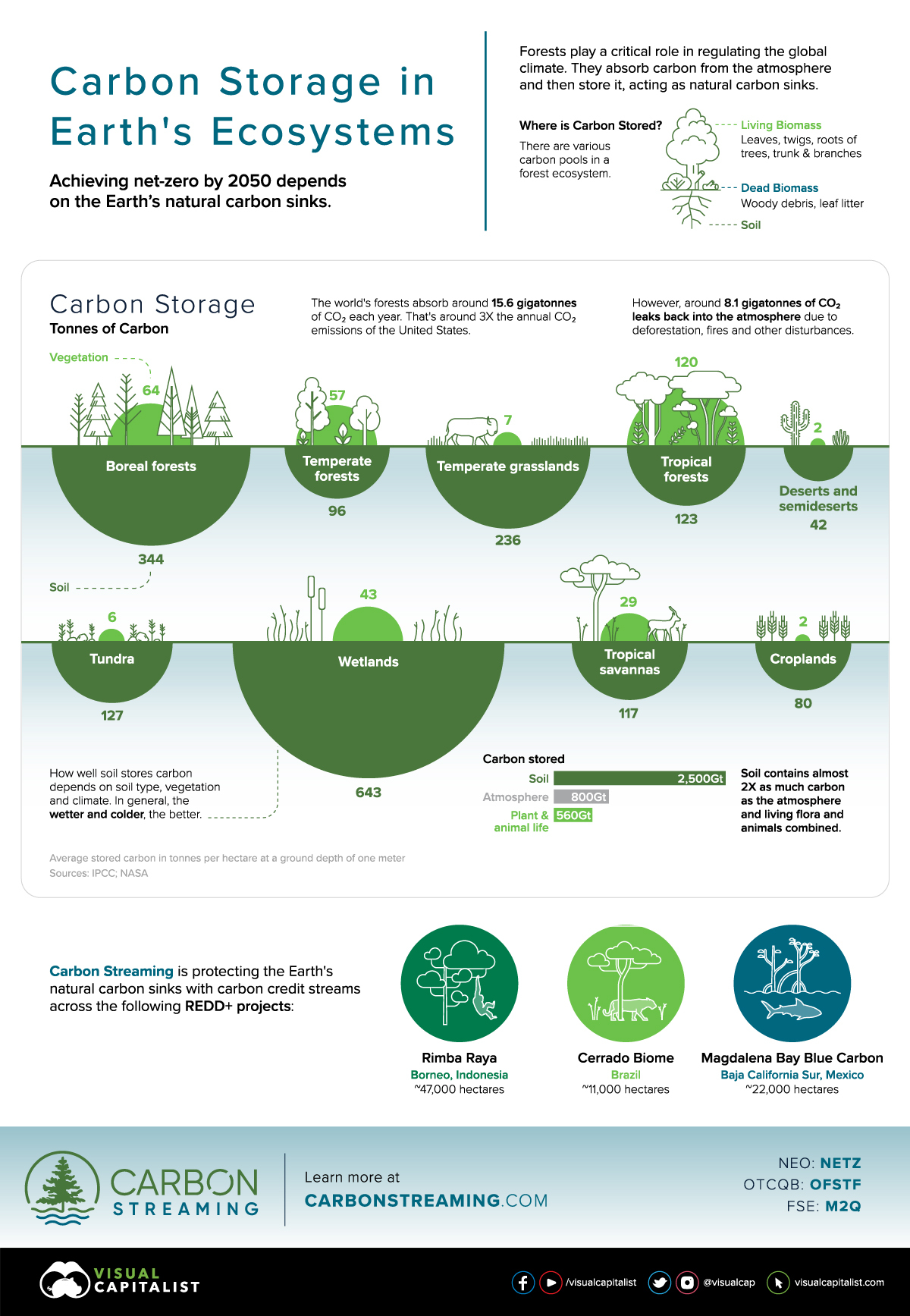

Carbon Cycle: Represents the process of carbon moving between different 'reservoirs' — such as the atmosphere, oceans, and living organisms — on Earth.

Carbon Footprint: The total carbon emissions of a portfolio, normalized by the portfolio’s market value, measured in tons of CO2 equivalent (CO2e) per million dollars invested.

Carbon Insetting: Carbon insetting refers to efforts by organizations to reduce emissions within their own supply chains and operations by investing in sustainable and carbon-reducing activities, often in the same geographic regions where they operate.

Carbon Intensity: The amount of carbon emissions produced per million dollars of revenue, used to assess the carbon efficiency of a portfolio or a company.

Carbon Market Price: The current market value or price per ton of carbon dioxide equivalent (CO2e) emissions allowances or carbon credits in a carbon trading market. Prices can fluctuate based on supply and demand.

Carbon Market Registry: A centralized database or platform where carbon credits, emission allowances, and related information are recorded and tracked. It ensures transparency, accuracy, and integrity in carbon market transactions.

Carbon Negative: Achieved when a company, sector, or country removes more CO2 from the atmosphere than it emits.

Carbon Offset Portfolio: A collection of investments in carbon offset projects, such as reforestation or renewable energy, designed to neutralise an investor's carbon footprint.

Carbon Pricing: A policy mechanism that places a price on carbon emissions, either through carbon taxes or emissions trading systems (cap-and-trade). It encourages businesses and individuals to reduce their carbon emissions by imposing a financial cost on emitting greenhouse gases.

Carbon Sequestration: Carbon sequestration is the process of capturing and storing carbon from the atmosphere, typically in forests, soils, or geological formations, to reduce the concentration of CO2 in the atmosphere and mitigate climate change.

Catalytic Capital: A form of investment that encompasses debt, equity, guarantees, and other financial instruments. It willingly accepts higher risks and/or lower returns compared to conventional investments to generate positive impact. It also enables third-party investments that might not otherwise be possible, thereby catalyzing positive change.

CBAM (Carbon Border Adjustment Mechanism): CBAM is a policy tool that aims to address carbon leakage, where companies relocate to regions with laxer emissions regulations. It imposes tariffs on imported goods based on their carbon footprint to create a level playing field for domestic industries.

CCS (Carbon Capture and Storage): CCS is a technology that captures carbon dioxide (CO2) emissions from industrial processes and power plants, transports the CO2 to storage sites, and stores it underground to prevent it from entering the atmosphere and contributing to climate change.

CCUS (Carbon Capture, Utilisation and Storage): Technologies that capture carbon dioxide from fuel combustion or industrial processes, transporting it, and then either using it to create valuable products/services or storing it underground.

CDFIs (Community Development Finance Institutions): Mission-driven financial institutions offering credit and financial services to underserved markets and populations, focusing on economic empowerment.

CDP (formerly Carbon Disclosure Project): An organization that requests and collects information from companies about their environmental impact, including carbon emissions and water use. Learn More

CDVC (Community Development Venture Capital): Venture capital funds that aim to invest in companies and entrepreneurs who generate social and financial returns in underinvested communities.

Ceres: Ceres is a nonprofit organization mobilising business leadership and investor support for a sustainable global economy. It works with influential investors and companies to address climate change, water scarcity, and other sustainability challenges. Learn More

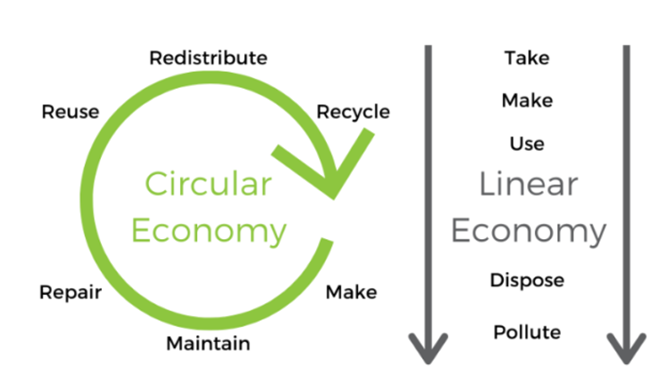

Circular Economy: A production and consumption model focusing on extending the life cycle of products through sharing, leasing, reusing, repairing, refurbishing, and recycling, reducing waste significantly.

Citizens Assembly: A citizens assembly is a deliberative forum composed of randomly selected individuals who come together to discuss and make recommendations on complex issues, including climate policy and environmental matters.

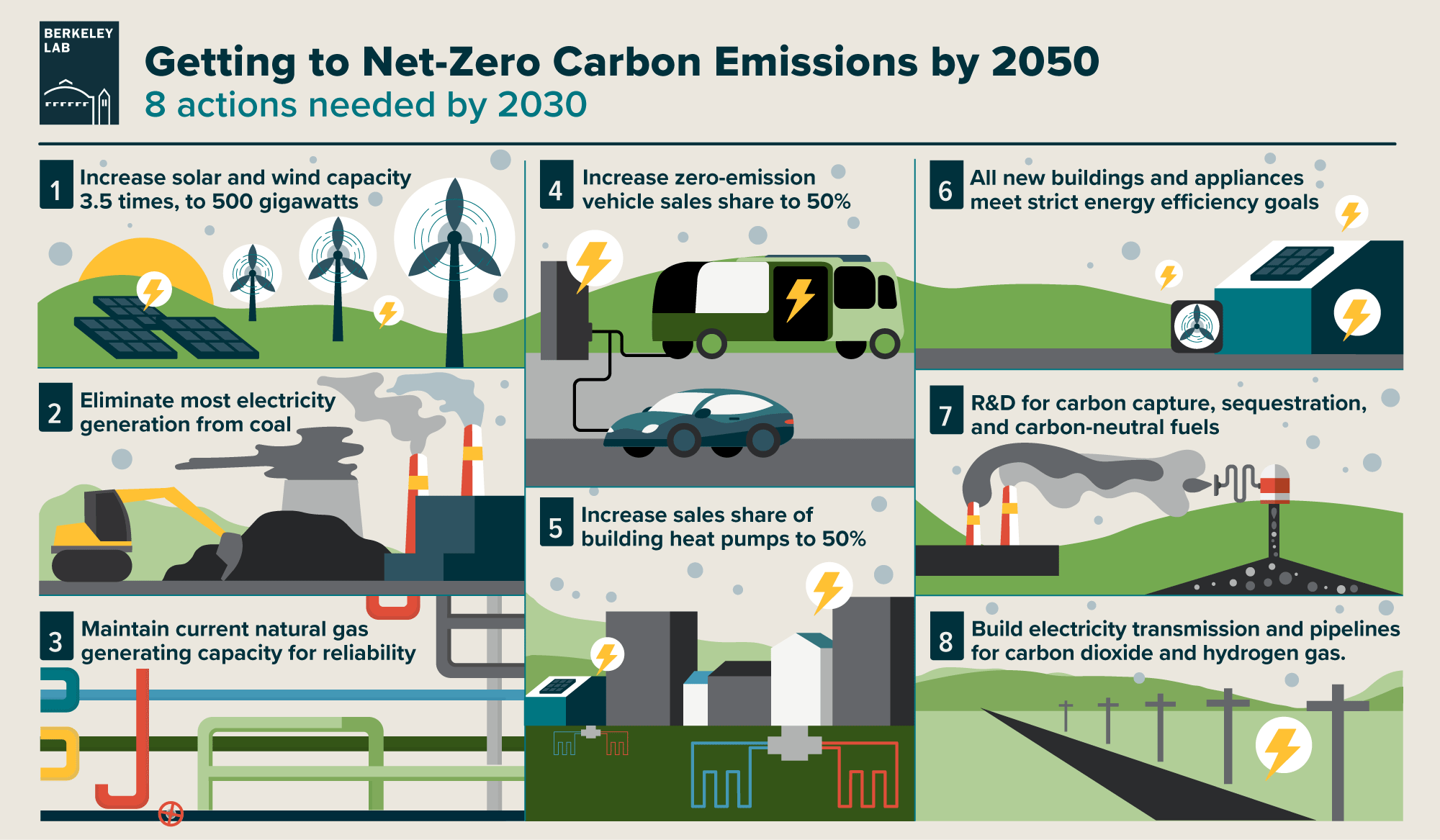

Clean Energy: Energy sources and technologies that produce minimal or no harmful emissions of greenhouse gases and other pollutants. It includes renewable energy sources such as solar, wind, hydroelectric, and geothermal power, as well as energy efficiency measures and technologies aimed at reducing environmental impact and promoting sustainability.

Clean Energy Certificate (REC, PPA):

Certificates that represent the environmental attributes of electricity generated from clean energy sources, such as wind or solar. Renewable Energy Certificates (RECs) and Power Purchase Agreements (PPAs) allow organizations to purchase or trade clean energy credits to meet sustainability goals.

Clean Energy Infrastructure Fund: An investment fund that targets clean and renewable energy infrastructure projects, such as electric vehicle charging networks or grid upgrades.

Clean Energy Transition Strategy:

A strategic plan or approach adopted by governments, organizations, or investors to shift from fossil fuel-based energy sources to clean and sustainable alternatives. It often involves policy measures, investments, and incentives to accelerate the transition.

Climate Action Plan (CAP): A strategic and detailed framework for measuring, planning, and reducing greenhouse gas emissions and climatic impacts.

Climate Bonds Initiative: An international organization that promotes the development of the green and sustainable bond market. They provide certification and standards for Green Bonds. Learn More

Climate Finance Facility: A financial institution or fund that provides financing for climate-related projects, such as renewable energy installations or climate adaptation efforts.

Climate Justice: Climate justice advocates for equitable and fair responses to climate change, emphasising the rights and needs of vulnerable and marginalised communities who often bear the brunt of climate impacts.

Climate-Positive Investment Strategy: An investment approach that seeks to not only reduce carbon emissions but actively contribute to reversing climate change through investments in carbon capture and removal technologies.

Climate Reparations: Climate reparations refer to financial compensation or assistance provided to countries and communities that have suffered disproportionately from the impacts of climate change, often due to historical emissions from wealthier nations.

Climate Risk: The potential negative impacts of climate change on economic and financial systems, including both physical risks and transition risks associated with moving to a low-carbon economy.

Climate Stripes: Climate Stripes, often referred to as "Climate Spiral" or "Warming Stripes," is a data visualization method that uses a series of colored stripes to represent historical temperature trends. Each stripe typically corresponds to a single year, and the color of the stripe represents the temperature anomaly for that year, with warmer years shown in warmer colors (e.g., red) and cooler years in cooler colors (e.g., blue). Climate Stripes provide a visual representation of how global temperatures have changed over time, highlighting the trend of increasing temperatures due to climate change. Learn More

Climate Transition Bonds: Bonds issued to finance projects aimed at transitioning an organization or industry to a low-carbon or climate-resilient future.

CO2e (Carbon Dioxide Equivalent): CO2e is a unit of measurement that combines the global warming potential of various greenhouse gases into a single metric, usually expressed in terms of CO2 emissions. It allows for the comparison of the overall impact of different greenhouse gases on climate change.

Co-Investment: In the context of private equity, co-investment involves the syndication of a financing round or investment with other funders alongside a private equity fund. In venture philanthropy, it entails the syndication of investments in social purpose organizations by additional funders (e.g., grant-makers or individuals) alongside an impact investor. Co-investment enhances collaboration and pooling of resources to drive social and financial objectives.

Compliance Carbon Market: A segment of the carbon market where companies and entities are legally obligated to meet emission reduction targets or purchase emission allowances to comply with government regulations or emissions caps.

Concessionary Finance: Refers to investment strategies that are willing to accept some financial sacrifice, such as taking on greater risks or accepting lower returns, in exchange for generating higher societal impact. It falls within the broader category of impact investing and embodies the willingness to undertake risks that many others may not.

Conservation Easement: A legal agreement between a landowner and a conservation organization or government agency. It restricts certain land uses to protect the property's natural, scenic, or historic features, ensuring its long-term conservation.

Conservation Finance: The financial mechanisms and strategies employed to support the protection, restoration, and sustainable management of natural resources and ecosystems. It encompasses a range of funding sources, including public and private investments, grants, impact investments, and innovative financial instruments designed to address environmental conservation and biodiversity preservation challenges.

Convertible Loans: Also known as convertible debt, are financial instruments that represent loans with the option to convert them into equity. These loans are commonly used to support social purpose organisations with limited credit ratings and high growth potential. Convertible loans offer the benefits of debt initially while allowing conversion into equity in the future, making them suitable for early-stage investments.

Clean Development Mechanism: A mechanism under the Kyoto Protocol enabling developed countries to finance projects that reduce or remove greenhouse gas emissions in developing countries, earning carbon credits in return.

Clean Energy Transition: Refers to the global shift from fossil fuel-based energy sources to cleaner and more sustainable alternatives such as renewable energy (e.g., solar, wind, hydropower) and energy efficiency measures. It is a critical response to mitigate climate change and reduce greenhouse gas emissions.

Corporate Social Investor (CSI): Can include corporate foundations, impact funds, accelerators, and social businesses, are entities that support innovative solutions to societal challenges. They provide capital to social purpose organisations (e.g., NGOs, social enterprises) through grants, debt, equity, as well as expertise and non-financial support. CSIs are often associated with companies and are dedicated to creating intentional, additional, and measurable impact.

Cradle to Cradle (C2C): A design and manufacturing concept that focuses on creating products that can be fully recycled or safely returned to the environment after use, with no waste or pollution generated.

CSRC (China Securities Regulatory Commission): The main regulator of the securities industry in China. Learn more.

CSRD (Corporate Sustainability Reporting Directive): The CSRD is a proposed European Union regulation that aims to improve the quality and comparability of sustainability reporting by companies, ensuring transparency and accountability in their environmental and social practices. Learn more

Custodian Bank: A financial institution responsible for safeguarding and holding the assets of institutional investors, ensuring their security and proper administration.

D.

DAF's (Donor Advised Funds): Charitable giving vehicles allowing donors to make tax-advantaged contributions and recommend grants over time, with options for impact investment.

Dark Green Bonds: A category of Green Bonds that are issued to fund projects with a particularly strong environmental impact.

Debt for Nature Swaps: Financial agreements in which a portion of a country's outstanding debt is forgiven or restructured in exchange for the country's commitment to invest in environmental conservation and sustainability initiatives. These arrangements aim to address both financial obligations and environmental concerns, promoting biodiversity preservation and sustainable practices.

Decarbonisation: The process of reducing or eliminating carbon dioxide (CO2) emissions, particularly in the context of energy production, transportation, and industrial processes. The primary goal of decarbonisation is to mitigate climate change by transitioning to low-carbon or carbon-neutral technologies and practices. Decarbonisation is a crucial strategy to limit global warming and achieve net-zero emissions, as outlined in climate agreements like the Paris Agreement.

Deforestation: Human-driven and natural loss of trees, affecting wildlife, ecosystems, weather patterns, and the climate.

Degradation: The deterioration or decline in the quality, condition, or productivity of natural resources, ecosystems, or the environment. It encompasses various forms of damage or harm to the environment, including soil degradation, deforestation, water pollution, habitat destruction, and biodiversity loss.

DFI (Development Finance Institution): Government-backed financial institutions that provide capital to companies and projects in developing countries for economic development purposes.

DIB's (Development Impact Bonds): Financing instruments for projects in low and middle-income countries, where investors fund specific social interventions and are repaid based on successful outcomes.

Diversity and Inclusion (D&I): An ESG factor that assesses a company's commitment to promoting diversity among its employees and fostering an inclusive workplace culture. It includes considerations of gender, race, ethnicity, and other demographics.

Divestment: The deliberate process of selling or reducing investments in companies, industries, or assets that are deemed environmentally or socially harmful. It is often driven by ethical, social, or environmental concerns and is a strategy employed by investors to align their portfolios with sustainability goals.

DOTS (Development Outcome Tracking System): A system used by development finance institutions to track and measure the results of their investments in terms of development outcomes.

Double Materiality: A concept in ESG investing that recognises the dual impact of environmental, social, and governance (ESG) factors. It considers not only the materiality of ESG issues to a company's financial performance but also the materiality of a company's activities to broader societal and environmental concerns.

Doughnut Economics: An economic model proposed by economist Kate Raworth. It envisions an economic system that operates within the "doughnut," representing a safe and just space for humanity, while avoiding both environmental overshoot and social inequalities. Learn More

Dry Powder: The uninvested or unused capital that a venture capital firm has available for making new investments. It represents the financial resources that the firm has on hand but has not yet deployed into portfolio companies. Having a substantial amount of dry powder allows a venture capital firm to take advantage of investment opportunities as they arise, participate in funding rounds, and support the growth of existing portfolio companies. The term "dry powder" emphasizes the readiness and liquidity of available capital for investment purposes.

Due Diligence: The process by which investors, typically venture capitalists, thoroughly investigate a startup or company before making an investment. It involves assessing the company's financials, operations, management team, market potential, and legal matters.

E.

Earthshot Prize: The Earthshot Prize is a prestigious global environmental award program initiated by Prince William, the Duke of Cambridge, and the Royal Foundation. It aims to incentivize and reward innovative solutions to the world's most pressing environmental challenges, including climate change, biodiversity loss, pollution, and more. The Earthshot Prize seeks to inspire collaboration, drive innovation, and accelerate progress towards achieving ambitious environmental goals over the next decade. Learn More

EBRD (European Bank for Reconstruction and Development): An international financial institution that supports projects in over 30 countries from central Europe to central Asia, investing in sectors such as agribusiness, energy efficiency, and infrastructure. Learn more.

ECGI (European Corporate Governance Institute): An international scientific non-profit association that provides a forum for debate and dialogue between academics, legislators, and practitioners, focusing on corporate governance. Learn more.

EEA (European Economic Area): A European territory consisting of the member states of the European Union and three European Free Trade Association states, promoting the free movement of goods, services, capital, and persons.

Eco-Anxiety: Short for ecological anxiety, refers to the psychological distress and unease that individuals may experience due to concerns about environmental issues and the future of the planet. It is a type of anxiety that arises from the perceived threats and challenges posed by climate change, biodiversity loss, habitat destruction, and other environmental crises.

Ecological Footprint: Measures the environmental impact of human activities in terms of the natural resources and ecosystems required to support those activities. It assesses sustainability by comparing resource consumption to the Earth's capacity to regenerate.

Ecocide: The extensive damage, destruction, or loss of ecosystems, including the significant harm caused to the environment through human activities. It encompasses actions that result in the severe degradation of ecosystems, the extinction of species, or the alteration of natural processes to the detriment of the planet's health and its ability to support life. Ecocide is considered a serious environmental and moral offense, and there have been discussions about its potential recognition as an international crime. Efforts are underway to establish legal frameworks and international treaties to prevent and address ecocidal acts and promote greater accountability for actions that harm the Earth's ecosystems and biodiversity. The concept of ecocide underscores the importance of protecting the environment and fostering sustainable practices to ensure the well-being of future generations and the planet as a whole.

Ecosystem Services: The benefits and resources that humans obtain from the natural environment and the functioning of ecosystems. These services can be grouped into several categories, including provisioning services (such as food, water, and timber), regulating services (such as climate and disease regulation), supporting services (such as nutrient cycling and habitat provision), and cultural services (such as recreation and cultural heritage). Ecosystem services are essential for human well-being and economic development, and they play a crucial role in maintaining the health and balance of ecosystems.

ECT (Energy Charter Treaty): The Energy Charter Treaty is an international agreement that governs energy investments and trade, promoting cooperation and protection of energy-related investments.

Emission Allowance: A tradable permit issued by a government or regulatory body that allows the holder to emit a specific quantity of greenhouse gases, usually expressed in metric tons of CO2e (carbon dioxide equivalent). These allowances can be bought, sold, or traded in carbon markets.

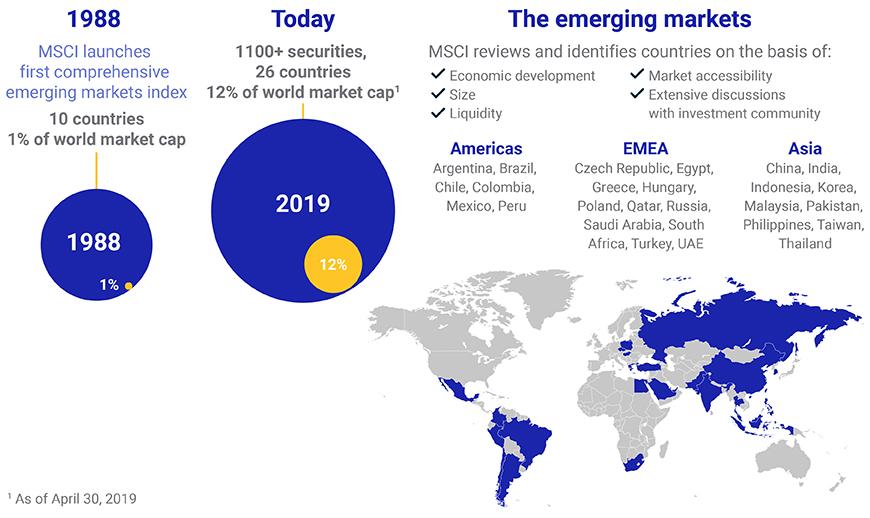

Emerging Market: A country that has some characteristics of a developed market but does not meet standards to be a developed market. This includes countries that may be becoming more engaged with global markets as they grow.

EMPEA (Emerging Market Private Equity Association): An independent association that represents private equity and venture capital firms investing in emerging markets. Learn more.

Environmental Factors: Considerations taken into account by responsible investors when analyzing investments, such as climate change, resource depletion, waste, pollution, and deforestation.

EPFI (Equator Principles Financial Institution): Financial institutions that have officially adopted the Equator Principles, a risk management framework for determining, assessing, and managing environmental and social risk in project finance. Learn more.

ERR (Economic Rate of Return): A measure used to evaluate the economic profitability of an investment, considering the net present value of all costs and benefits.

ESG (Environmental, Social, and Governance): Non-financial factors used by investors to evaluate companies, including environmental efficiency, social practices, and governance transparency.

ESG Integration (Environmental, Social, and Governance Integration): The practice of incorporating ESG factors into investment decision-making and management, considering their financial materiality and broader impact.

ESG Risk Assessment: Evaluating the potential environmental, social, and governance risks that could impact the financial performance of an investment. It helps investors identify and manage ESG-related risks.

Ethical Investing: Ethical investing, also known as socially responsible investing (SRI), involves selecting securities or investments based on ethical criteria. Investors avoid companies or industries that do not align with their values or ESG principles.

EU (European Union): A political and economic union of 27 European countries that are located primarily in Europe, which participate in a single market allowing free movement of goods, capital, services, and people. Learn more.

ETS (Emissions Trading System): An ETS is a market-based approach to limit greenhouse gas emissions by allocating and trading emission allowances or permits. It incentivizes emission reductions and allows for the trading of excess permits.

EU ETS (EU Emissions Trading System): The world's first and largest carbon market, operating on a 'cap and trade' principle.

EVPA (European Venture Philanthropy Association): EVPA is a European network of organizations focused on creating positive societal impact through venture philanthropy and social investment. It promotes effective, impactful, and responsible investing for social change. Learn More

Exit Strategy: The planned method for investors to realize a return on their investment in a startup or company. Common exit strategies include acquisition by a larger company or an initial public offering (IPO).

F.

Fair Trade Certification: Standards that ensure fair wages, labor practices, and environmental responsibility in the production of various goods, especially in agriculture. Learn More

Family Office: A private wealth management organization that provides comprehensive financial and personal services to high-net-worth individuals or families. The primary purpose of a family office is to manage and preserve the wealth of the family across generations. These can be divided into SFO's (Single Family Office) established to exclusively serve the financial and personal needs of a single high-net-worth family or individual and MFO's who pool the resources of several families to provide a shared platform for wealth management services.

Feed-In Tariff (FiT): A policy mechanism where renewable energy producers are paid a set rate for the electricity they generate and feed into the grid, typically above market rates.

Fiduciary Duty: The legal and ethical responsibility of institutional investors to act solely in the best interests of their scheme members.

Financial Inclusion: Ensuring access to a full suite of quality financial services, delivered responsibly and sustainably, to meet the needs of individuals and businesses.

First Close: A significant milestone in a venture capital fund's fundraising process. It occurs when the fund reaches a predetermined minimum amount of committed capital from investors, allowing the fund to commence investments. The first close typically involves a substantial portion of the fund's target capital but may not yet reach the full fundraising goal. After the first close, the venture capital fund can start making investments in startups and other opportunities.

Fixed Income: Securities that provide investors with a fixed, regular income and return the principal at the end of a predetermined term.

Funding Round: A specific stage of fundraising in which a startup or company seeks investment from external sources, such as venture capitalists. Funding rounds are often designated as "Seed Round," "Series A," "Series B," etc., depending on the stage of growth.

Fund of Funds (FoF): An investment fund that pools capital from investors and allocates it to multiple underlying investment funds, providing diversification across strategies and asset classes.

G.

G7 Impact Taskforce: An initiative to foster and advance impact investing among the world’s leading investors, part of a broader effort to integrate impact considerations into mainstream investing. Learn More

G20 (Group of Twenty): The Group of Twenty is an international forum for governments and central bank governors from 19 countries and the European Union. It addresses global financial stability, economic growth, sustainable development, climate change, and other pressing issues. Learn More

GAAP (Generally Accepted Accounting Principles): A common set of accounting principles, standards, and procedures that companies must follow when they compile their financial statements.

GRI (Global Reporting Initiative): An international independent organization that helps businesses, governments, and other organizations understand and communicate their impact on issues such as climate change, human rights, and corruption. Learn more.

Gender Lens Investing: An investment approach that considers gender-related factors, such as promoting gender equality and women's empowerment, when making investment decisions. It seeks to address gender disparities and create positive social and financial outcomes.

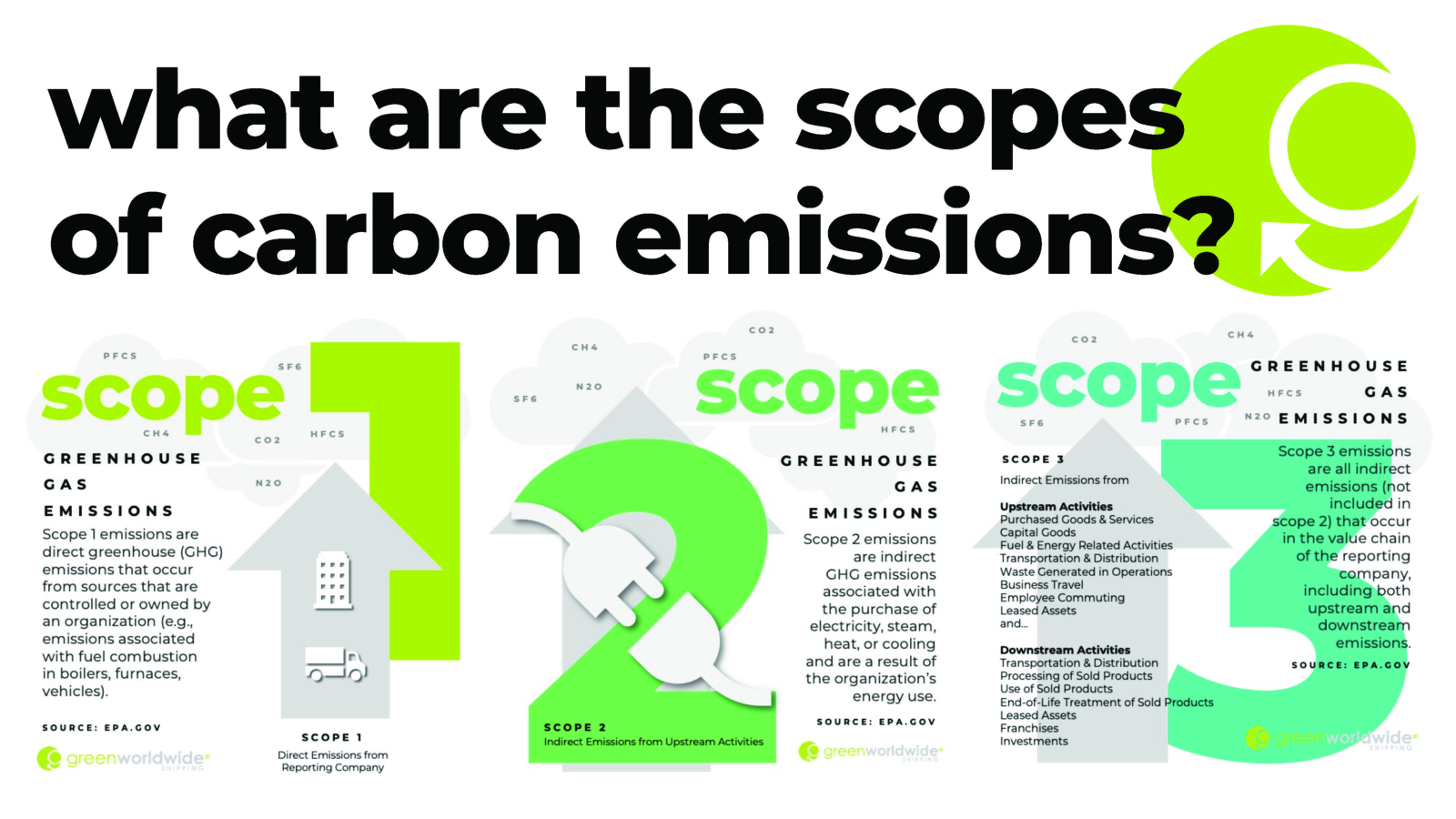

GHG (Greenhouse Gas) Emissions: Emissions of gases that trap heat in the atmosphere, such as carbon dioxide (CO2).

GHG Protocol: Provides comprehensive methods for measuring and managing greenhouse gas emissions from private and public sector operations, value chains, and mitigation actions.

GIIN (Global Impact Investing Network): The Global Impact Investing Network is a nonprofit organization dedicated to increasing the scale and effectiveness of impact investing. It provides resources, research, and a network for impact investors and organizations seeking to generate social and environmental impact alongside financial returns. Learn More

GIIRS (Global Impact Investing Rating System): (pronounced gears) A comprehensive, rigorous assessment of a company's or a fund's social and environmental impact. Learn more.

Global Stocktake: The Global Stocktake is a process under the United Nations Framework Convention on Climate Change (UNFCCC) that assesses the collective progress of countries in meeting their climate goals and evaluates the adequacy of global efforts to address climate change.

Global South: Encompasses the regions of Latin America, Africa, Asia, and Oceania, particularly vulnerable to the adverse effects of climate change.

Global Warming: The long-term increase in Earth's average surface temperature due to human activities, primarily the emission of greenhouse gases.

GP (General Partner): A partner in a limited partnership or a private equity fund responsible for managing the fund's operations and investments. GPs typically take an active role in making investment decisions, overseeing portfolio companies, and executing the fund's strategy. They have unlimited liability for the fund's debts and obligations, which means their personal assets are at risk. GPs are often compensated through management fees and a share of the fund's profits, known as carried interest.

GPIF (Government Pension Investment Fund, Japan): One of the world's largest pension funds, responsible for managing the pension reserves of Japan's national pension system. Learn more.

Green Bonds: Fixed-income securities funding environmentally beneficial projects, issued by sovereign or non-sovereign entities. They are part of the growing green financing market.

Green Bond Fund: An investment fund that primarily holds green bonds, which are issued to finance environmentally beneficial projects and initiatives.

Green Energy Certificate (GEC): Also known as Renewable Energy Certificates (RECs) or Tradable Renewable Certificates (TRCs), these are tradable certificates that represent the environmental benefits of generating electricity from renewable sources.

Green Financing: Financial investments into sustainable development projects and initiatives, environmental products, and policies that support a more sustainable economy.

Green Bond Framework: A document outlining an issuer's commitment to environmental sustainability and how Green Bond proceeds will be used. It includes details on eligible projects, reporting, and impact measurement.

Green Bond Principles (GBP): A set of voluntary guidelines and best practices developed by the International Capital Market Association (ICMA) for issuing Green Bonds. They cover transparency, disclosure, and reporting.

Green Finance Taskforce (GFT): Established by the UK government to promote the growth of green finance and the UK’s low carbon economy.

Greenhouse Gases: Greenhouse gases are atmospheric gases, including CO2, methane (CH4), and nitrous oxide (N2O), that trap heat from the sun, contributing to the greenhouse effect and global warming.

Green Crowding: Green crowding happens when a company inundates the market with eco-friendly claims or labels, making it challenging for consumers to distinguish between genuinely sustainable products and those merely capitalizing on the green trend.

Green Gilding: Green gilding refers to exaggerating the environmental benefits of a product or service through deceptive marketing techniques, such as highlighting insignificant eco-friendly features while downplaying negative impacts.

Green Hushing: Green hushing occurs when a company intentionally avoids publicizing its environmentally damaging actions or policies. Instead of actively promoting green initiatives, the company remains silent about its unsustainable practices.

Green Investing: An investment approach that focuses on the environmental credentials of investments.

Green Investment Bank: A Green Investment Bank is a financial institution that specializes in funding green and sustainable projects, including renewable energy initiatives.

Green Rinsing: Green rinsing involves allocating a small portion of a company's budget or resources to eco-friendly projects or products while the majority of its operations remain environmentally harmful. It creates the illusion of commitment to sustainability without genuine efforts.

Green Spinning: Green spinning occurs when a company selectively shares positive environmental actions or achievements while diverting attention away from larger, more significant environmental problems within the organization.

Green Washing: Misleading exaggeration of the environmental benefits of an investment product or service, a form of deceptive marketing in the environmentally responsible investment space.

GRI (Global Reporting Initiative): An international independent organization that helps businesses, governments, and other organizations understand and communicate their impact on issues such as climate change, human rights, and corruption. Learn more.

GRI Standards (Global Reporting Initiative): A comprehensive set of standards for sustainability reporting, which includes economic, environmental, and social performance metrics. Learn More

Grid Parity: The point at which the cost of generating electricity from renewable sources becomes equal to or less than the cost of generating electricity from conventional sources.

GSG (Global Steering Group for Impact): A UK-based charity that unites leaders from finance, business, and philanthropy to address global social and environmental challenges. Learn more

H.

Handprint: In the context of sustainability and environmental impact, a "handprint" represents the positive actions and contributions made by individuals, organizations, or initiatives to mitigate or counteract their negative environmental "footprint." While a carbon footprint measures the negative environmental impact, such as greenhouse gas emissions or resource consumption, a handprint focuses on the positive efforts to reduce or offset that impact.

HBL (Habib Bank Limited): Pakistan's largest bank that provides a broad range of banking and financial services. Learn more.

Hedge Fund: A pooled investment vehicle that employs various strategies to generate returns for accredited or institutional investors, often with less regulation than traditional funds.

High Net Worth Individual (HNWI): A person or household with substantial financial assets and wealth that exceed a certain threshold. HNWIs typically have a net worth, which includes assets like investments, real estate, and cash, well above the average. The specific threshold to qualify as an HNWI can vary by financial institutions and regions but often starts in the range of several hundred thousand dollars or more. HNWIs often have access to a wide range of financial services and investment opportunities tailored to their affluent status.

HIPSO (Harmonized Indicators for Private Sector Operations): A set of indicators developed by development finance institutions to measure the development impact of private sector investments. Learn more

HKEX (Hong Kong Stock Exchange): The primary stock exchange in Hong Kong, it plays a key role in the financial market of Asia. Learn more.

Hydropower: Electricity generated by harnessing the energy of flowing water, typically from rivers or dams, using turbines to produce electricity.

I.

ICMA (International Capital Market Association) Green Bonds Principles: ICMA's Green Bonds Principles are voluntary guidelines for the issuance of green bonds. They promote transparency, integrity, and consistency in the green bond market. Learn More

IFC (International Finance Corporation): A member of the World Bank Group, it is an international financial institution that offers investment, advisory, and asset management services to encourage private sector development in less developed countries. Learn more.

IFI (International Financial Institution): Financial institutions that have been established (or chartered) by more than one country, and hence are subjects of international law. Their owners or shareholders are generally national governments, although other international institutions and other organizations occasionally figure as shareholders.

IFRS (International Financial Reporting Standards): A set of accounting standards developed by the International Accounting Standards Board (IASB) that is becoming the global standard for the preparation of public company financial statements. Learn more.

IIGCC (Institutional Investors Group on Climate Change): A global investor membership organization specifically focusing on climate change. Learn more

IIRC (International Integrated Reporting Council): The International Integrated Reporting Council promotes integrated reporting, which combines financial and non-financial information to provide a comprehensive view of an organization's value creation story. Learn More

IMM (Impact Money Multiple): A metric used in impact investing to measure the financial return on investment alongside the social or environmental impact generated.

IMP (Impact Management Project): A forum for building global consensus on how to measure, manage, and report impacts on sustainability. Learn more.

Impact Investing: Deploying capital in ways that generate specific, positive environmental or social impacts, alongside a financial return for investors.

Impact Investing Institute: An independent, non-profit organization based in the UK, established to accelerate the growth and enhance the effectiveness of the impact investing market.

Impact Investing Principles for Pensions: A four-point framework enabling pension schemes to adopt an impact investing strategy while fulfilling their fiduciary duties.

Impact-Linked Securities: Financial instruments that offer returns tied to specific sustainability or impact performance targets, aligning investor incentives with positive outcomes.

Impact Management Project: Focused on building global consensus on measuring, assessing, and reporting the social and environmental impacts of investments.

Impact Measurement and Management (IMM): The process of measuring, monitoring, and managing the social and environmental impact of investments, including setting impact goals and using standardized metrics.

Impact Metrics: Quantitative and qualitative measurements used to evaluate and assess the social, environmental, and economic outcomes and effects of investments, projects, or initiatives. These metrics provide a standardized and systematic way to gauge the effectiveness and success of impact-driven activities.

Impact Reporting and Investing Standards (IRIS): A catalog of metrics developed by the Global Impact Investing Network for measuring and reporting social, environmental, and financial performance in impact investing.

Impact Washing: Overstating the social or environmental benefits of an investment product, often for financial incentives, exploiting the lack of consumer awareness around sustainable and impact investing.

Index Fund: An investment fund that aims to replicate the performance of a specific market index (e.g., S&P 500) by holding a similar portfolio of securities, often with lower fees.

Indigenous Wisdom: Refers to the profound knowledge, practices, and cultural traditions passed down through generations by indigenous or native communities. It encompasses a deep understanding of the natural world, ecosystems, and sustainable ways of living in harmony with nature. Indigenous wisdom is rooted in the interconnectedness of all living beings and the environment.

Institutional Investor: Manages capital on behalf of its members, policyholders, or beneficiaries, often working with in-house or external asset managers.

Intentionality: The deliberate aim of an impact investor to contribute to specific, positive, and measurable social or environmental outcomes.

Intermittent Energy Sources: Renewable energy sources like wind and solar power that are not continuously available and can vary in output.

Invasive Species: Non-native species that are introduced to new ecosystems and can harm native species and ecosystems.

IORP II (Institutions for Occupational Retirement Provision Directive): European Union directive that sets out rules and standards for the activities and supervision of institutions for occupational retirement provision.

IPA (Innovations for Poverty Action): A research and policy non-profit that discovers and promotes effective solutions to global poverty problems. Learn more.

IPO (Initial Public Offering): The process by which a private company can go public by sale of its stocks to general public. It could be a new, young company or an old company which decides to be listed on an exchange and hence goes public.

IPCC (Intergovernmental Panel on Climate Change): Evaluates and assesses the scientific research related to climate change. Learn more

IPCF (International Panel for Climate Finance): An independent collaborative framework designed to act as a bridge in climate finance.

IPO (Initial Public Offering): The process by which a private company offers its shares to the public for the first time, becoming a publicly traded company. It is a common exit strategy for venture-backed startups.

IRIS (Impact Reporting and Investment Standards): A set of standardized metrics that impact investors use to measure social, environmental, and financial success, to ensure consistency and comparability of impact data. Learn more.

IRIS+ (Impact Reporting and Investment Standards+): An expanded version of the Impact Reporting and Investment Standards (IRIS), developed by the Global Impact Investing Network (GIIN). It is a comprehensive set of standardized metrics and indicators used by impact investors and organisations to measure, report, and manage the social, environmental, and financial performance of impact investments. IRIS+ provides a common language and framework for assessing the impact of investments in areas such as healthcare, education, renewable energy, and poverty alleviation. It supports transparency and accountability in impact investing by enabling consistent measurement and reporting of impact outcomes. IRIS+ helps investors and stakeholders make informed decisions and track progress toward social and environmental goals.

IRR (Internal Rate of Return): A metric used in financial analysis to estimate the profitability of potential investments. It is a discount rate that makes the net present value of all cash flows equal to zero.

ISO 14001 (Environmental Management System Standard): An international standard for environmental management systems. It helps organizations manage and improve their environmental performance. Learn More

ISO 26000 (Guidance on Social Responsibility): Provides guidance on integrating social responsibility into an organization's values and practices. It addresses various aspects of social responsibility. Learn More

ISSB (International Sustainability Standards Board): Responsible for developing global sustainability-related disclosure standards to meet investors' information needs, enhancing global consistency in reporting. Learn more

J.

J-Curve Effect (JCE): An economic phenomenon that describes a temporary worsening of a country's trade balance following a devaluation of its currency. Over time, the trade balance is expected to improve as exports become more competitive.

J-PAL (Abdul Latif Jameel Poverty Action Lab): A global research center working to reduce poverty by ensuring that policy is informed by scientific evidence. Learn more.

Just Transition: A concept that focuses on ensuring that the shift towards a sustainable economy (such as transitioning to a low-carbon economy) is inclusive and fair for all stakeholders, particularly those who may be disproportionately affected, such as workers and communities dependent on high-carbon industries. It emphasizes the need for equitable distribution of the benefits of a green transition and the mitigation of its potential negative impacts on certain groups. The concept underscores the importance of dialogue between stakeholders, including governments, companies, and civil society, to manage the social implications of environmental policies and investments.

JV (Joint Venture): A business arrangement where two or more companies collaborate to undertake a specific project or business activity. Each participant contributes resources and shares in the risks and rewards of the venture.

K.

Kyoto Protocol: Commits industrialised countries and economies in transition to limit and reduce greenhouse gas emissions in line with agreed-upon individual targets. Learn more

L.

Leakage: Leakage refers to the unintended increase in emissions in one location due to emission reductions or actions taken elsewhere. For example, emissions reductions in one country may lead to increased emissions in another due to changes in trade or production patterns.

Loss and Damage: Refers to the adverse impacts of climate change that go beyond the capacity of affected communities or countries to adapt. It encompasses the irreversible loss of lives, livelihoods, and ecosystems due to extreme weather events, sea-level rise, and other climate-related phenomena. Loss and Damage recognizes that some climate change impacts cannot be prevented or fully mitigated and require international support for recovery and resilience-building efforts. It is a critical component of climate negotiations and discussions under the United Nations Framework Convention on Climate Change (UNFCCC).

Long-Short Strategy: An investment approach used by hedge funds that involves simultaneously buying (going long) and selling (going short) assets to profit from both rising and falling markets.

Long-Term Horizon: An investment approach that focuses on generating returns over an extended period, aligning with the objectives of institutional investors with long-term liabilities.

Low-Carbon Portfolio: A low-carbon portfolio is a collection of securities selected to minimise exposure to carbon-intensive industries and promote a transition to a low-carbon economy.

LP (Limited Partner) : An investor in a limited partnership or private equity fund who provides capital to the partnership but does not play an active role in its management. LPs have limited liability, meaning their personal assets are not at risk beyond their initial investment. They typically receive a share of the fund's profits, often through a distribution waterfall structure. LPs are passive investors and rely on the GPs to make investment decisions and manage the fund's assets.

M.

Materiality Assessment: A process used by companies to identify and prioritize ESG issues that are most relevant and impactful to their business and stakeholders. It helps in focusing ESG reporting efforts on key areas.

MCPP (Managed Co-Lending Portfolio Program): A program that enables third-party investors to passively participate in IFC’s senior loan portfolio.

MDB (Multilateral Development Bank): An international financial institution chartered by two or more countries to encourage economic development.

MFI (Microfinance Institution): Organizations that offer financial services to low-income clients or groups who traditionally lack access to banking and related services.

Microfinance: Financial services for low-income entrepreneurs, including microcredit, savings, insurance, and other basic financial services, typically underserved by traditional banks.

Mitigation: Efforts to reduce or prevent the emission of greenhouse gases.

Mission Related Investment (MRI): Investments from a tax-exempt foundation's endowment aimed at generating financial returns and furthering its charitable mission.

Montréal Carbon Pledge: Allows investors to formalize their commitment to measure, disclose, and reduce their portfolio carbon footprints. Learn more

N.

Natural Asset Company (NAC) : To address the large and complex challenges of climate change and the transition to a more sustainable economy, NYSE and Intrinsic Exchange Group (IEG) are creating a new class of listed company based on nature and the benefits that nature provides (see ecosystem services). NACs will capture the intrinsic and productive value of nature and provide a store of value based on the vital assets that underpin our entire economy and make life on earth possible. Learn more

Natural Capital: The world's stocks of natural assets, including geology, soil, air, water, and living organisms, forming the basis of ecosystem services essential for life.

Natural Capital Accounting: An accounting framework that quantifies and assesses the value of natural resources and ecosystems within economic systems. It assigns economic values to environmental assets and services, allowing for a more comprehensive understanding of their contributions to the economy. This approach supports informed decision-making that considers the conservation and sustainable management of natural capital.

Natural Capital Fund: An investment vehicle that focuses on preserving and enhancing natural capital assets, including forests, wetlands, and ecosystems.

Nature-Based Solutions (NBS): Strategies addressing societal challenges through the protection, sustainable management, and restoration of natural ecosystems, leveraging nature's services.

Nationally Determined Contributions (NDCs): NDCs are climate action plans and commitments submitted by individual countries to the United Nations Framework Convention on Climate Change (UNFCCC). These contributions outline a country's specific goals, targets, and measures to address climate change and reduce greenhouse gas emissions. NDCs are a central component of the Paris Agreement, which aims to limit global warming to well below 2 degrees Celsius above pre-industrial levels, with an aspiration to limit it to 1.5 degrees Celsius. Each country's NDC reflects its unique circumstances and capabilities, and they are typically updated or revised over time to reflect increased ambition and progress in addressing climate change.

NCQG (Nature Conservancy's Quantitative Group): The NCQG is a specialized team within The Nature Conservancy, a prominent environmental conservation organization. This group focuses on quantitative research and analysis related to environmental and conservation issues. Their work often involves the development and application of scientific and mathematical models to assess the impact of various conservation strategies, understand ecological systems, and inform decision-making in the field of conservation. The NCQG plays a crucial role in providing data-driven insights and evidence-based solutions to address biodiversity conservation, ecosystem restoration, and sustainable natural resource management.

Negative Screening: Excludes companies involved in undesirable activities or sectors from an investment portfolio.

Net-Zero: Achieving a balance between the greenhouse gases put into the atmosphere and those removed, without relying on carbon offsetting.

Net-Zero Asset Managers Alliance: A coalition of asset managers committed to supporting the goal of net-zero greenhouse gas emissions by 2050 or sooner.

Net-Zero Asset Owner Alliance: A group of institutional investors dedicated to transitioning their investment portfolios to net-zero greenhouse gas emissions by 2050.

Non-Governmental Organization (NGO) : A private, nonprofit entity that operates independently of government control. NGOs are typically formed by individuals or groups to address a wide range of social, environmental, humanitarian, or developmental issues. They play a crucial role in advocacy, service delivery, and community development. NGOs can vary in size and scope, from local grassroots organizations to large international entities. Their work may involve providing aid, conducting research, raising awareness, advocating for policy change, and implementing programs to benefit society.

O.

Ocean Acidification: Ocean acidification is the process by which the world's oceans become more acidic as they absorb excess CO2 from the atmosphere, leading to adverse effects on marine ecosystems and species.

OECD (Organisation for Economic Co-operation and Development): An international organization that works to build better policies for better lives, with member countries committed to democracy and the market economy. Learn more.

OECD-DAC (Organisation for Economic Co-operation and Development–Development Assistance Committee): A forum of many of the largest funders of aid, including 30 OECD member countries, that discuss issues surrounding aid, development, and poverty reduction in developing countries. Learn more.

Offsetting : The practice of compensating for one's environmental impact, such as carbon emissions, by investing in projects or activities that reduce or remove an equivalent amount of greenhouse gases from the atmosphere.

Offset Project: An initiative or activity that reduces or removes greenhouse gas emissions from the atmosphere, such as reforestation, renewable energy projects, or methane capture. These projects generate carbon credits that can be used in carbon markets.

Offset Verification: The process of assessing and confirming the environmental integrity and legitimacy of carbon offset projects. It involves independent audits to ensure that emissions reductions claimed by offset projects are accurate and credible.

OJK (Financial Services Authority of Indonesia): An Indonesian government agency that regulates and supervises the financial services sector in Indonesia. Learn more.

One Health: One Health is a collaborative and multidisciplinary approach that recognises the interconnectedness of human health, animal health, and environmental health. This approach recognizes that the health of humans, animals, and ecosystems are closely intertwined, and addressing health challenges requires collaboration, research, and policies that consider these interdependencies. One Health is particularly relevant in the context of emerging infectious diseases, antimicrobial resistance, and environmental changes that impact health.

Organizational Resilience: An organization's ability to adapt, recover, and thrive in the face of disruptions, crises, or unforeseen challenges. It encompasses strategies, preparedness, and risk management practices to ensure business continuity.

P.

Paris Alignment: Aligning public and private financial flows with the objectives of the Paris Agreement on climate change.

PCAF (Platform Carbon Accounting Financials): Develops and implements a harmonized approach for assessing and disclosing the GHG emissions associated with loans and investments. Learn more

PDC (Portfolio Decarbonization Coalition):

A multi-stakeholder initiative aimed at reducing greenhouse gas emissions by mobilizing institutional investors committed to decarbonizing their portfolios.

Payments for Ecosystem Services (PES): Financial incentives provided to landowners or communities in exchange for implementing land management practices that contribute to ecosystem conservation. These payments can include compensation for actions like reforestation, watershed protection, or carbon sequestration.

Philanthropic Foundations: Charitable organizations established by individuals, families, or corporations with the primary mission of supporting various social, environmental, or educational causes. These foundations manage endowments and distribute grants or funding to nonprofit organizations, NGOs, and other initiatives that align with their philanthropic goals. Foundations vary in size, focus areas, and grantmaking strategies. They often play a critical role in funding research, community development, innovation, and solutions to pressing global challenges. Some well-known examples of philanthropic foundations include the Bill and Melinda Gates Foundation and the Ford Foundation.

Pension Fund: A retirement savings plan sponsored by an employer or government entity, designed to provide income to retirees based on contributions and investment returns.

Physical Risks:

Risks arising from changing climate conditions, including both acute, episodic risks and chronic, ongoing risks

Planetary Boundaries: The ecological limits or thresholds that define the safe operating space for humanity within the Earth's system. Crossing these boundaries could lead to severe environmental consequences. Learn More

Portfolio Company: A business in which a venture capital firm has made an investment. Venture capitalists typically manage a portfolio of companies in which they have invested capital.

PPA (Power Purchase Agreement): A contractual agreement between a buyer and a seller of electricity. In the context of clean energy, a PPA is often used to facilitate the purchase of electricity generated from renewable energy sources, such as wind farms or solar installations. Under a PPA, the buyer (often a corporation, utility, or institution) agrees to purchase the electricity produced by the renewable energy project at a predetermined price over a specified period, typically several years to decades. PPAs provide financial certainty to renewable energy developers and help support the development and financing of clean energy projects.

PPF/SWF (Public Pension Funds and Sovereign Wealth Funds): Government-owned investment funds or entities that manage national savings for the purposes of investment.

PME (Public Market Equivalent): A benchmarking methodology used in private equity to evaluate the performance of an investment against a publicly traded benchmark.

PPM (Private Placement Memorandum): A legal document provided to prospective investors when selling stock or another security in a business.

PRI (Principles for Responsible Investing): A United Nations-supported network of investors that work together to promote sustainable investment through the implementation of six aspirational principles. Learn more.

Private Equity: Investments in privately held companies or assets, often with the goal of achieving long-term growth or improving operational efficiency.

Proxy Voting: The process by which shareholders, including ESG-focused investors, exercise their voting rights in corporate matters. It allows investors to influence corporate governance decisions and ESG-related resolutions.

Q.

Qualified Opportunity Zones (QOZ): Economically distressed communities in the United States where investors can receive tax incentives for investing in designated funds aimed at spurring economic development and job creation.

Quantitative Easing (QE): A monetary policy tool used by central banks to stimulate the economy. It involves the purchase of financial assets (such as government bonds) to increase the money supply and lower interest rates, aiming to promote economic growth.

R.

REC (Renewable Energy Certificate): A tradable environmental certificate that represents the environmental attributes of electricity generated from renewable energy sources, such as wind, solar, hydroelectric, or biomass. RECs are used to track and verify the renewable energy content of electricity and are issued for each megawatt-hour (MWh) of renewable energy generated.

Regenerative Economics: An approach to economic systems that seeks to restore and enhance the well-being of both human societies and the natural world. It aims to create regenerative, sustainable, and inclusive economies. Learn More

Real Estate Investment Trust (REIT): A specialized REIT that primarily holds environmentally friendly and energy-efficient real estate assets.

REM (Rapid Evidence Mapping): A method used to quickly map out and categorize existing knowledge or evidence on a particular topic or sector.

Renewable Energy Fund: A fund that invests in renewable energy assets, such as wind farms, solar installations, and hydropower projects.

Renewable Portfolio Standard (RPS): A policy requiring utilities to generate a certain percentage of their electricity from renewable energy sources, often with specified targets and deadlines.

Resilience Thinking: An approach that emphasizes building the capacity of systems, communities, and organizations to adapt and thrive in the face of change and uncertainty, including environmental and social challenges.

Responsible Investment: Responsible investment is a broader concept that encompasses ESG integration, ethical investing, and impact investing. It involves making investment decisions that align with ethical and sustainability principles.

Responsible Supply Chain Management: Ethical and sustainable practices employed by companies to manage and monitor their supply chains. It includes efforts to ensure fair labor practices, environmental sustainability, and social responsibility among suppliers and partners.

Rewilding: Rewilding is a conservation strategy that aims to restore and protect natural landscapes by reintroducing native species, reducing human intervention, and allowing ecosystems to regenerate and function more independently.

Risk-Adjusted Return: A measure of investment performance that considers the level of risk taken to achieve a particular return, helping investors assess the efficiency of their investments.

ROI (Return on Investment): A performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments.

S.

SAF (Sustainable Aviation Fuel): An alternative to traditional fossil-based aviation fuels, designed to reduce the carbon footprint of aviation while promoting environmental sustainability. SAF is produced from renewable and sustainable feedstocks, such as plant-based oils, agricultural residues, municipal solid waste, and algae. It is specifically engineered to minimise greenhouse gas emissions and other pollutants generated by aircraft engines.

SASB (Sustainability Accounting Standards Board): Develops industry-specific standards for companies to disclose financially material sustainability information to investors. Learn More

Say on Climate: A strategy for investor support in advancing the transition planning of leading companies by securing a routine advisory vote on the quality of the companies' transition planning.

SBTi (Science Based Targets Initiative): Assists companies in setting greenhouse gas emission reduction targets in line with climate science. Learn more

Scenario Analysis: Assesses an investment portfolio’s alignment with a chosen future scenario, especially in the context of climate change.

Scope 1 Emissions: Direct emissions from sources that are owned or controlled by an entity. Scope 1 emissions typically include emissions from combustion in owned or controlled boilers, furnaces, vehicles, as well as emissions from chemical production in owned or controlled process equipment.

Scope 2 Emissions: Indirect emissions associated with the purchase of electricity, steam, heat, or cooling. Although the entity does not physically release these emissions, they are a consequence of the entity's energy use. Scope 2 emissions occur at the place where the energy is generated.

Scope 3 Emissions: All indirect emissions (not included in Scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions. This can encompass a wide range of emissions sources, such as the extraction and production of purchased materials and fuels, transport-related activities in vehicles not owned or controlled by the entity, electricity-related emissions not covered in Scope 2, outsourced activities, waste disposal, etc.

SCR (Solvency Capital Requirement): The amount of funds that insurance and reinsurance companies in the EU are required to hold under the Solvency II Directive.

SDG's (Sustainable Development Goals): A set of 17 goals adopted by UN member states in 2015, aiming to end poverty, tackle climate change, and preserve natural resources by 2030. Learn More

SDG 1 - No Poverty: SDG 1 aims to eradicate poverty in all its forms and dimensions worldwide. It seeks to ensure that all people, especially the poor and vulnerable, have equal access to basic services, economic opportunities, and social protection.

SDG 2 - Zero Hunger: SDG 2 focuses on ending hunger, achieving food security, improving nutrition, and promoting sustainable agriculture. It aims to ensure that everyone has access to nutritious food and that food production is environmentally sustainable.

SDG 3 - Good Health and Well-being: SDG 3 aims to ensure healthy lives and promote well-being for all at all ages. It addresses a wide range of health issues, including maternal and child health, infectious diseases, and access to essential healthcare services.

SDG 4 - Quality Education: SDG 4 focuses on providing inclusive and equitable quality education for all. It aims to ensure that everyone has access to lifelong learning opportunities, and it emphasizes the importance of education in achieving other sustainable development goals.

SDG 5 - Gender Equality: SDG 5 promotes gender equality and empowerment of all women and girls. It seeks to eliminate gender-based discrimination and violence, ensure equal opportunities, and ensure women's participation in decision-making processes.

SDG 6 - Clean Water and Sanitation: SDG 6 focuses on ensuring the availability and sustainable management of clean water and sanitation for all. It aims to address water scarcity, improve water quality, and provide access to basic sanitation facilities.

SDG 7 - Affordable and Clean Energy: SDG 7 promotes access to affordable, reliable, sustainable, and modern energy for all. It emphasizes the transition to clean and renewable energy sources to combat climate change.

SDG 8 - Decent Work and Economic Growth: SDG 8 aims to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all. It addresses issues such as job creation, labor rights, and economic development.

SDG 9 - Industry, Innovation, and Infrastructure: SDG 9 focuses on building resilient infrastructure, promoting inclusive and sustainable industrialisation, and fostering innovation.